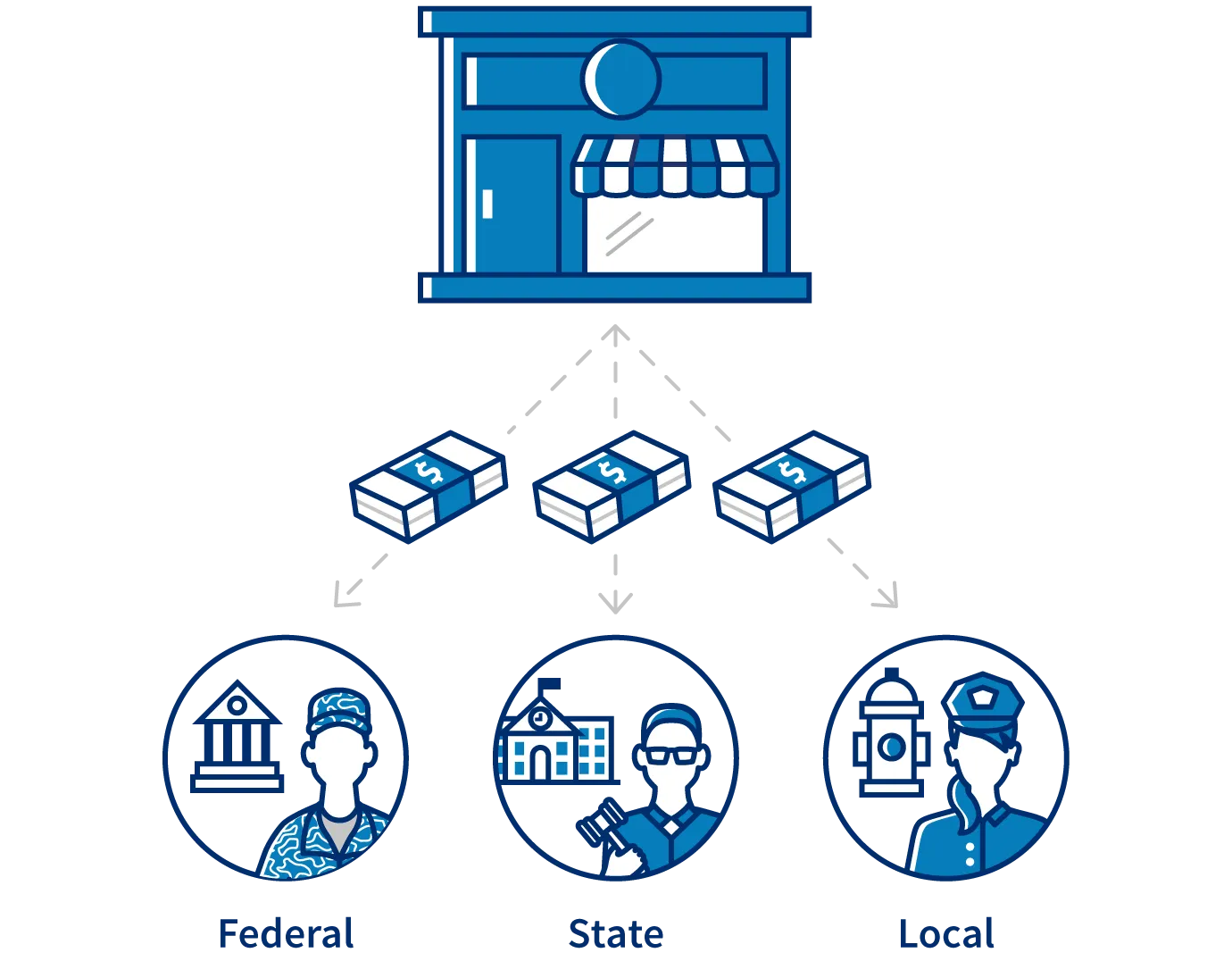

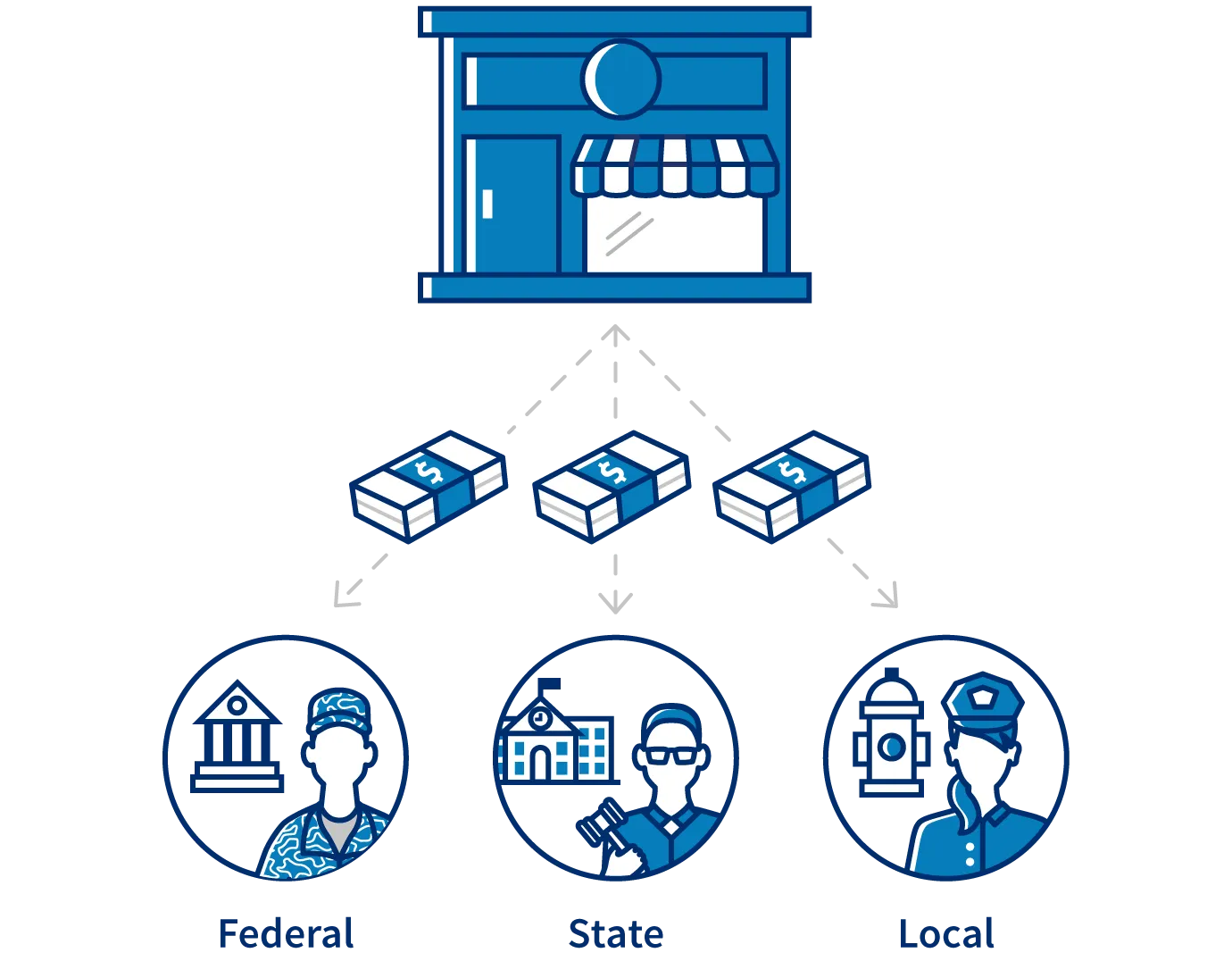

Your business will need to meet its federal, state, and local tax obligations to stay in good legal standing. Your business structure and location will influence which taxes your business has to pay.

Most businesses choose their tax year to be the same as the calendar year. You select your tax year the first time you file for taxes, but you can change it later with permission from the IRS.

If your business doesn’t have much reporting or bookkeeping, you might be required to use a calendar tax year. Check with the IRS for detailed rules about tax years.

Your business might need to pay state and local taxes. Tax laws vary by location and business structure, so you’ll need to check with state and local governments to know your business’ tax obligations.

The two most common types of state and local tax requirements for small business are income taxes and employment taxes.

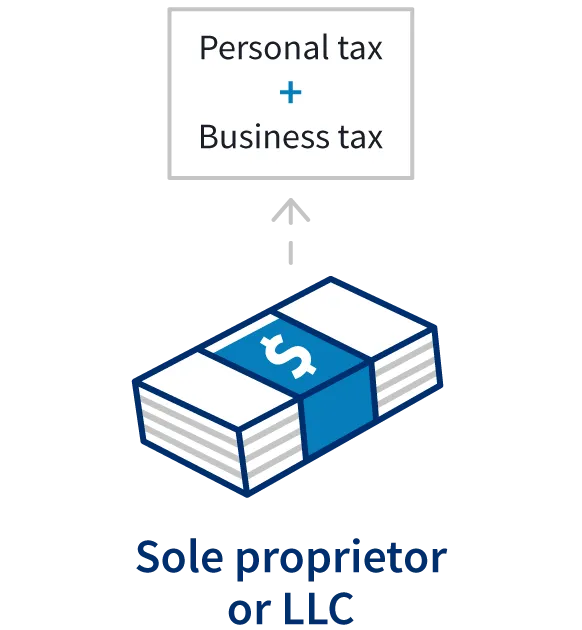

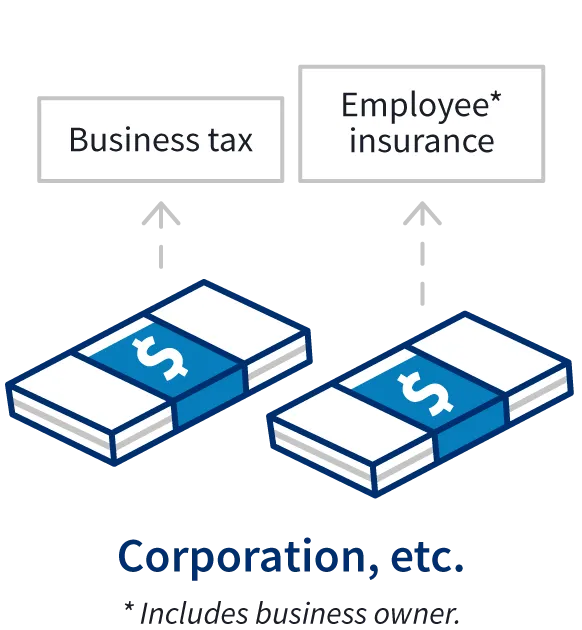

Your state income tax obligations are determined by your business structure. For example, corporations are taxed separately from the owners, while sole proprietors report their personal and business income taxes using the same form.

If your business has employees, you’ll be responsible for paying state employment taxes. These vary by state, but often include workers’ compensation insurance, unemployment insurance taxes, and temporary disability insurance. You might also be responsible for withholding employee income tax. Check with your state tax authority to find out how much you need to withhold and when you need to send it to the state.

Find out more about the business tax requirements in your state.